foras05/iStock via Getty Images

It’s been just under two months since I put out my article where I recommended people avoid the shares of FreightCar America Inc. (NASDAQ:RAIL) but sell puts on the stock, and since then the shares are down about 15.7% against a loss of about 11.4% for the S&P 500. The company has reported earnings since, and there has been some very interesting insider activity, so I thought I’d update people on this name. I’ll work out whether or not I think it makes sense to buy at current prices by looking at these updated financials and by looking at the stock as a thing distinct from the underlying business. I’m also going to update investors on the short put trade I recommended because I imagine you’re collectively champing at the bit, excited to hear the latest in this unfolding drama.

Welcome to the “thesis statement” portion of this article. It’s at this point where I offer you the gist of my thinking in case you missed the title and the three bullet points above. I’m generally impressed by the recent financial history here, and it confirms my growing belief that the freight car market is on the upswing. Additionally, I’m very encouraged by the fact that insiders have recently bought very near $3.50. You may remember that this is the net price I will acquire shares if the shares are “put” to me between now and the third Friday of January 2023. If you’re just joining us, I’d recommend selling the same puts I sold earlier. In spite of a pretty significant drop in the stock price, the premia on offer for the puts isn’t that much more significant.

Financial Update

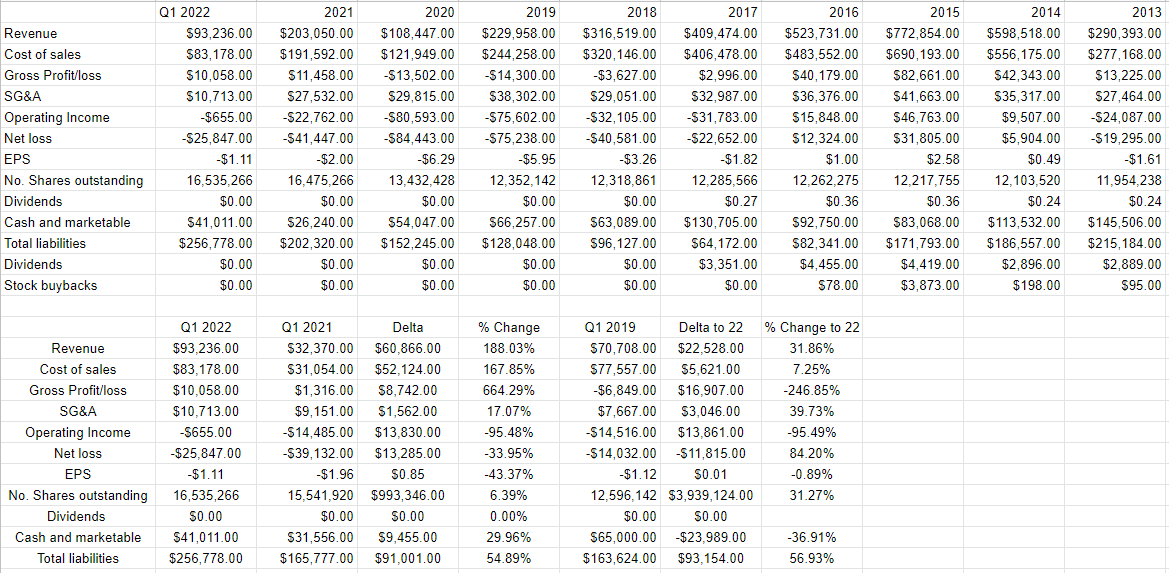

I think the financial performance during the most recent quarter falls somewhere between “good” and “very good.” Relative to the first quarter of last year, revenue was up by an eye watering 188%, and net loss shrunk by $13.3 million from $39.1 to $25.8 million. In case you’re worried that any comparison to the period of the pandemic is unnecessarily light on the company, worry no longer. Sales during the first quarter of 2022 were about $22.5 or 31.9% greater than they were in 2019. In fairness, though, net loss in Q1 2022 was about $11.8 million higher in 2022 than it was in 2019. Generally, though, I’d say there’s growing evidence that the company is recovering from the doldrums it’s been in since 2015-2016.

It’s not all sunshine and lollipops at FreightCar America, though. The level of total liabilities grew from $165.8 million in Q1 of 2021 to $256.8 million in Q1 of 2022. In fact, total liabilities rose by about $54 million in the first quarter of the year alone. While this is a troubling trend, I’d suggest that it’s not as troublesome as it might otherwise be, because the company remains very well capitalized. Specifically, they’re sitting on about $41 million of cash. Employing some of the mathematical skills so lovingly imparted to me by the good people at Holy Spirit School, this tells me that fully 16% of the liabilities are covered by cash.

All in, I think this turnaround is a decent buy at the right price.

FreightCar America Financials (FreightCar America investor relations)

The Stock

Ah, the phrase “at the right price.” It’s caused me to miss out on some rising stock prices, and my insistence on prices being reasonable has caused me to take profits on winning investments prematurely. I promise that’s not a persistent problem. Anyway, I consider stocks to be things quite distinct from companies, and this fact turns me into a bit of a “buzzkill” on occasion, because when I write about stocks, I remind people that a great company can be a terrible investment at the wrong price. If you’re not convinced, I’ll remind you that a company is an organisation that sells goods or services, hopefully for a profit. The stock, on the other hand, is an often-poor proxy for the company, as its price changes reflect more the mood of the crowd than anything related to the company. In particular, the stock is buffeted by the crowd’s changing attitudes about the very long-term future of a given company. It’s for this reason that I treat stocks and companies as distinct entities.

If you were hoping I was going to make this theoretical point and move on, I don’t know what to tell you at this point. If you are of the view that I’ll use 40 words when 300 will do, wrong you are. I’ll belabour this point by using FreightCar America itself as an example. The company released its quarterly results on May 10th. If you bought this stock that day, you’re up about 8.6% since. If you waited exactly six days before buying, you’re down about 4% since. Obviously, not much changed at “the company” over these six days to justify a 12.5% variance in returns from “the stock.” The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did better than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks.

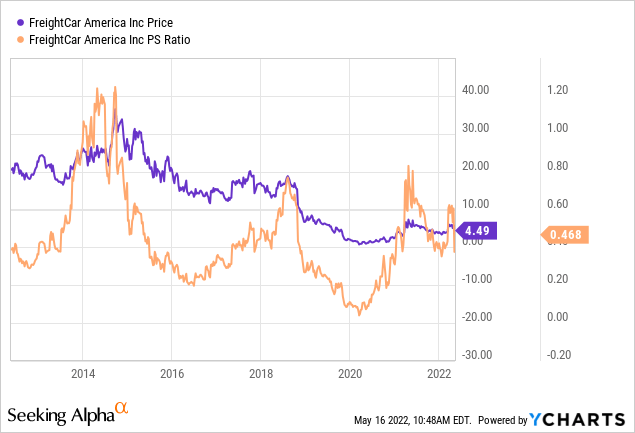

My regulars know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. When I last looked at FreightCar America, the stock was trading at a price to sales ratio of about .51. They’re now about 8% cheaper, per the following:

With Apologies To Orwell

All investors are created equal, but some are more equal than others. Let’s face it. Some investors do better than others. The reasons for this outperformance vary. Someone may have the intellectual and emotional makeup necessary to do well investing in stocks. Some people may have access to legions of talented analysts. Some are people who get rich because they dedicate themselves to a life of public service.

I think one group is particularly relevant for our discussion, though. The individuals who work at a given company are, by definition, more well informed about what’s going on with the company than a Wall Street analyst will ever be. For that reason, when these people do something, I think the rest of us would be wise to sit up and take notice.

With that in mind, I’d point out that earlier this month, three insiders, including the president and CEO, bought 86,940 shares at prices ranging between $3.48 and $3.68. In my view, when people who know a given business better than most of us ever will put their own capital to work, we should strongly consider following their lead. This strong insider buying activity at this price level suggests to me that $3.50 would be a reasonable entry price. It doesn’t guarantee anything, but being on the same side of the table as the people who know this business best helps me sleep at night.

Options Update

In my previous missive on this name, I recommended selling the January 2023 puts with a strike of $5 for $1.57. In spite of the drop in the stock price, these puts are only bid at $1.65 at the moment. Although I won’t be selling any more myself because I have enough exposure, I’d recommend people who are just joining us sell these puts. If the shares get above $5 over the next eight months, the investor will pocket a fairly decent premium, representing over 30% on the capital at risk. If the shares fall, the investor will be obliged to buy at approximately the same price as insiders this month. This is why I consider this to be a “win-win” trade. In my view, the results are great no matter what happens.

Welcome to the “risk” portion of the description of put options. If you read “win-win” and interpreted “risk free”, I’m sorry but I’m about to burst your bubble. After all, it’s all well and good for some stranger on the internet to characterize these things as “win-win” trades as I frequently do, but everything comes with some measure of risk, and short puts are no exception. I’m starting to divide the risks here between the economic and the emotional. Let’s review these in turn.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, before considering this type of trade, only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

The two other risks associated with my short-put strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that the market really likes what’s happening at FreightCar America, and that stock prices jump to $15, for instance. The short put only offers you the option premium. The return from the short put may be lower risk, but it’s certainly limited, and that can be emotionally painful for many.

Secondly, I can say from many years of painful experience that it can be emotionally painful when the shares crash below your strike price. While these trades have worked out well in the medium to long terms, largely because my strike prices are usually “screaming buys”, it is emotionally painful in the short term. So, I can make a reasonable argument that FreightCar America shares are a bargain at a net price of $3.50, but if they drop to $2 because of a market meltdown, for instance, that will take an emotional toll. I think people who sell puts should be aware of these emotional risks before selling.

I’ll conclude this rather long and tedious discussion of risks by looking again at the specifics of the trade I’m recommending. If shares of FreightCar America get back to $5 over the next several months, I’ll add the premium to other short puts I’ve written and move on. If the shares remain below $5, I’ll be obliged to buy at a net price of ~$3.45. Both outcomes are very acceptable in my view, so I consider this trade to be the definition of “risk reducing.” It may be strange to conclude a discussion of risk by describing how short puts can reduce risk. This is neither the first, nor will it be the last time you could describe my writing as “strange.”

Conclusion

I’m encouraged by the results I’m seeing here, and for that reason I’m comfortable remaining short the puts I wrote earlier. The top line is growing, and the firm is well capitalized. Additionally, the market remains nicely pessimistic here, in spite of the fact that insiders have bought aggressively. If you took my advice earlier, and sold some puts, I’d recommend holding on that trade. If you’re just coming to this party today, I strongly recommend selling the puts described here. You’ll either earn ~30% on the capital at risk and/or may be obliged to buy at the same level as people who know this business best. Either outcome is very acceptable in my view.