RudyBalasko

A research note came out a few days ago, July 20th, explaining why Caesars Entertainment (NASDAQ:CZR) could be the hardest hit among Las Vegas casinos in a 2022-23 recession. As consumers cut back on spending, especially travel to destinations like Vegas, the company’s extraordinary debt-load from years of ill-timed acquisitions could prove problematic according to Susquehannah analyst Joseph Stauff. He cautioned Caesars margins are likely to contract, earnings estimates were too high, and investors would start to worry about the size of debt obligations in a rising interest rate environment.

I have been concerned about the Caesars debt problem for years. I have even shorted shares now and again following my bearish January 2021 article here, explaining why an equity price above $80 was not sustainable. In the article I expressed a bearish view that appears to be coming true,

The standout risk is a jump in interest rates could shoot interest expense well above the present estimated annual cost approaching $2 billion (using Q3 as a proxy, annualized). A 2-3% interest rate/expense climb (over several years) could torpedo the net positives of the synergy claims by management.

Caesars and Las Vegas casinos in general have not seen a full recovery from COVID-19 travel cutbacks, and now another recession in customer traffic/reservations could be arriving. Equally bad for profits and margins, lower sales will be exacerbated by quickly rising labor wages and interest expense on tons of debt to build and operate casinos. Rapid expansion since early 2020 (merging with Eldorado Resorts and buying UK sports betting firm William Hill) has been financed with significant borrowings. Unfortunately, this buying spree was matched against a horrible operating environment during the pandemic reduction in travel.

Too Much Debt

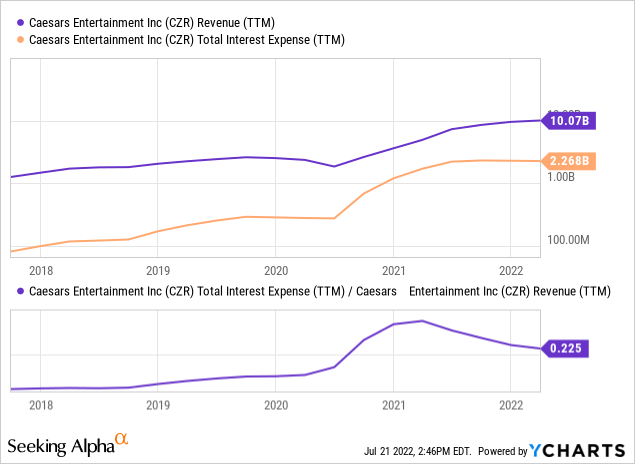

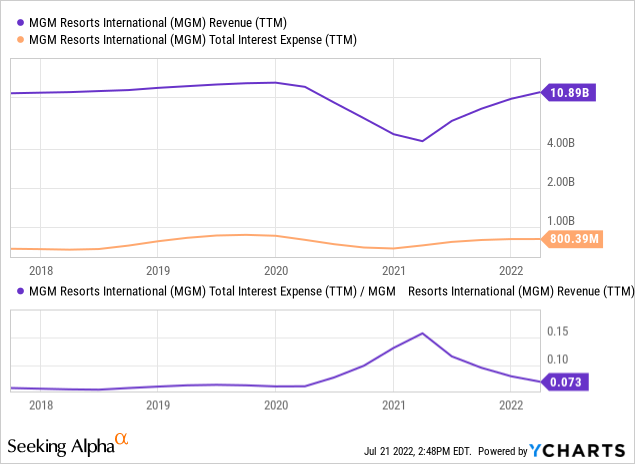

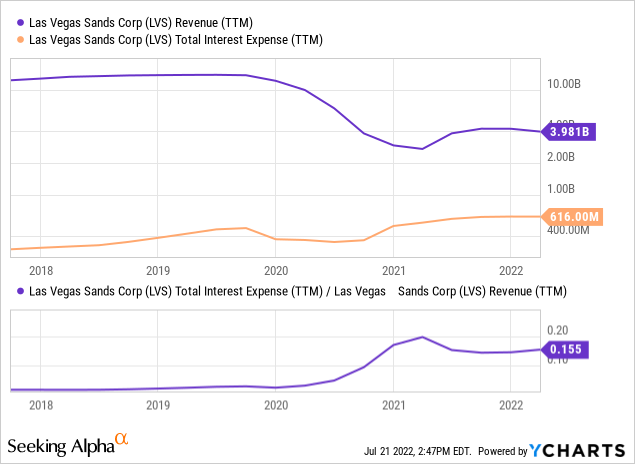

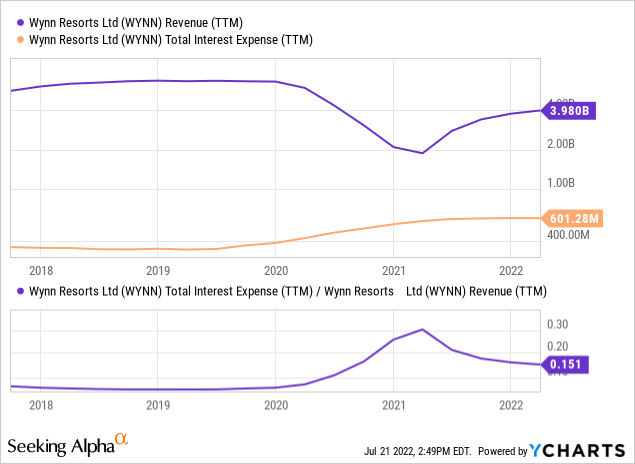

You can visualize the lagging sales caused by COVID-19 and the rising interest problem on the graphs below, with Caesars now expending an astronomical 22.5% of revenue generation on interest costs (compared to 6% in 2017), which my now accelerate higher in a one-two punch of recession declines in sales alongside rising interest costs on debt and leases on buildings/equipment. The squeeze on profit margins could be harsh, especially since Caesars is struggling to produce any type of GAAP income in 2022. Trailing annual interest expense and total revenues for Caesars, plus closest peers MGM Resorts (MGM), Las Vegas Sands (LVS), and Wynn Resorts (WYNN) since 2017 are pictured below.

YCharts

YCharts

YCharts

YCharts

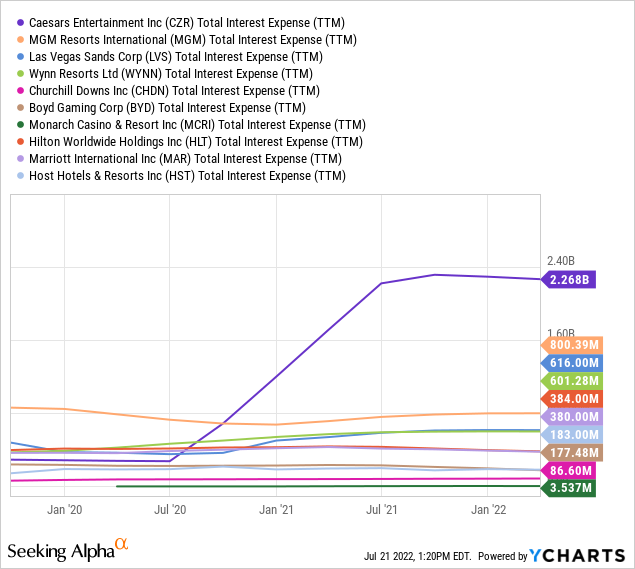

How big a hole on the balance sheet is Caesars debt? $25 billion in issued debt and lease obligations is the answer. Below is an annualized total interest/lease expense graph vs. the big Las Vegas casino operators, plus smaller casino names and the large hotel accommodation leaders. The $2.26 billion in annual debt service and lease operating costs is 3x the next largest hotel/casino spender. The expanded list of peers includes Churchill Downs (CHDN), Boyd Gaming (BYD), Monarch Casino (MCRI), Hilton (HLT), Marriott (MAR), and Host Hotels (HST).

YCharts

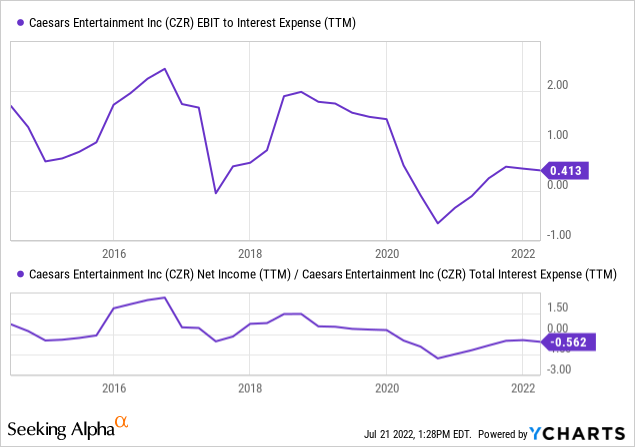

Rotten, overextended leverage going into a recession is the current setup for Caesars. After never fully recovering from the pandemic, a downturn in its business now could prove catastrophic for meeting its bills and supporting the common stock’s worth. Below is a graph showing how earnings before interest and taxes is not any greater than the level of interest expense currently, as operating losses have mounted since 2019.

YCharts

YCharts

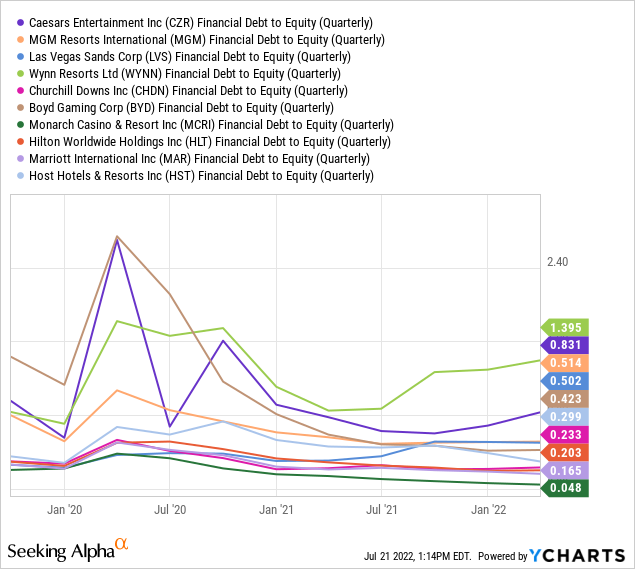

And total financial debt to equity is not improving much, as hoped by management when takeovers were announced. If earnings are headed south in a recession, this ratio may balloon as net equity declines and the requirement for new borrowings to afford rising interest expense appears.

YCharts

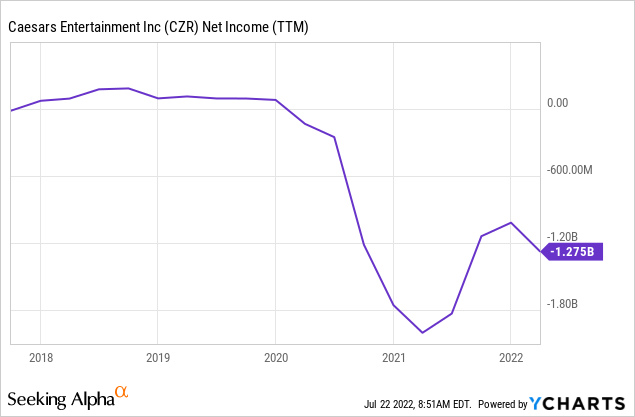

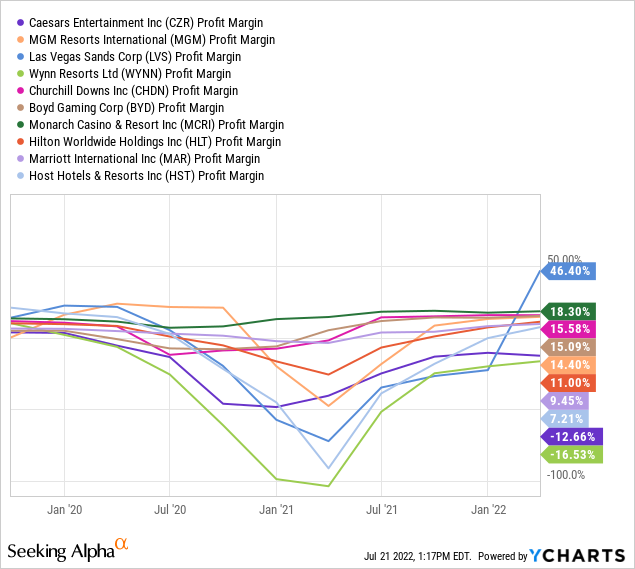

If Caesars cannot earn a profit on the rebound in travel spend in 2022, after COVID-19 closures in 2020 and reopenings in 2021, how can it sustain itself as sales turn lower in a recession? The horrible profit margin picture during a “good” year is drawn below.

YCharts

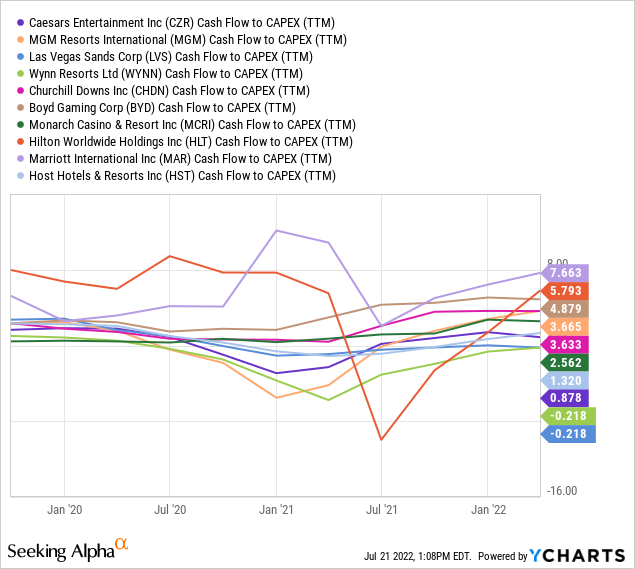

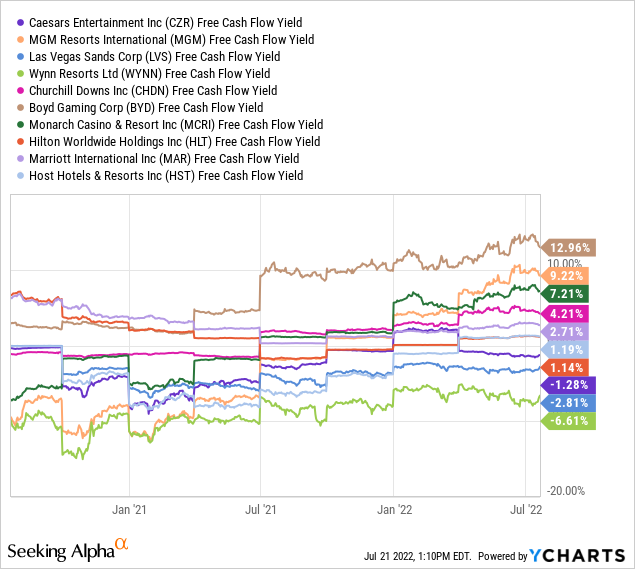

Even after adding back depreciation and amortization cash flows, the sustaining capital expenditure level to maintain customer traffic (and keep casinos competitive) has been outstripping the operating cash available to owners. In the end, negative free cash flow at an industry peak is very worrisome as the U.S. economy slides into reverse.

YCharts

YCharts

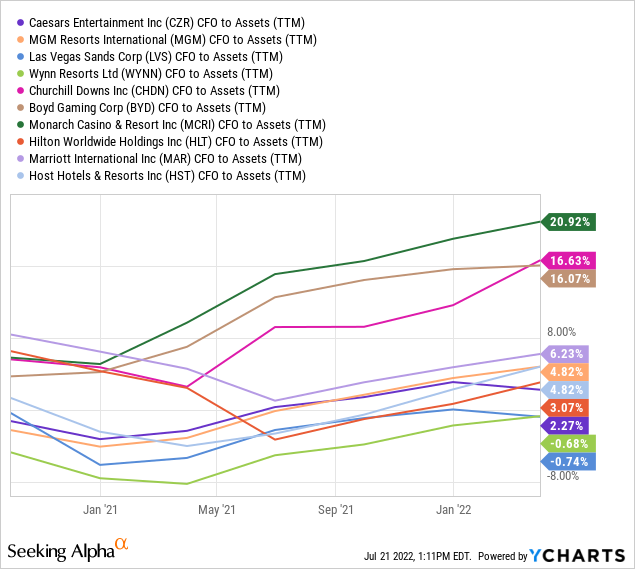

Finally, cash flow generation vs. total assets in 2022 is exceptionally low, meaning there is no room for error in the company’s optimistic forecast for future results. If cash flow dries up, where will the money come from to pay bills, interest on bonds, and other IOUs due?

YCharts

Bearish Momentum Trends

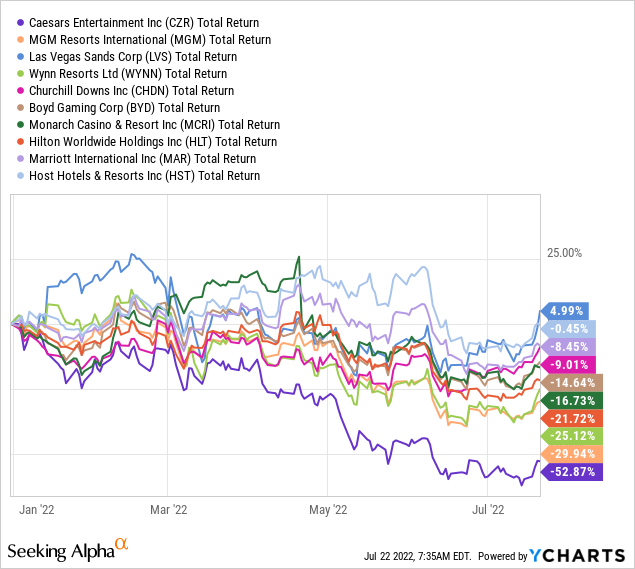

Needless to say, Caesars has been the worst performer in the peer group during 2022, as the macro environment could lead to financial trouble at the company. Over time, total interest on debt and lease rates for real estate look to explode higher with U.S. inflation. Concurrently, consumer spending and confidence is slowing from inflation-tripped disposable income issues. Against a -15% peer group median average total return drop, CZR’s -53% stands out.

YCharts

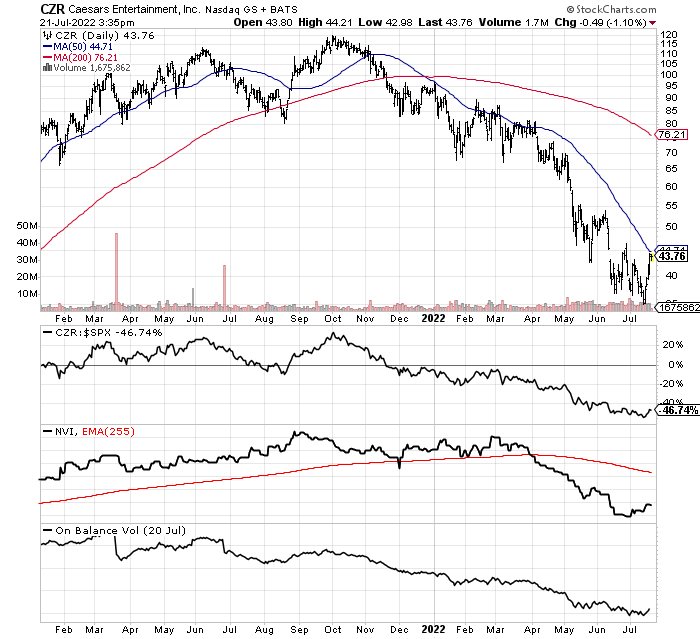

Since my last bearish article in January 2021, Caesars has underperformed the S&P 500 total return by -46%, pictured on the 18-month chart below. On Balance Volume has been leading price lower since March 2021. Plus, the Negative Volume Index has cratered since March of this year, telling us there is no real buying interest after steep selloff days. With price below the 50-day moving average now around $45, the technical trading layout and outlook remains incredibly negative.

18-Month Charts, Daily Values, CZR -StockCharts.com

Some Bullish Stats

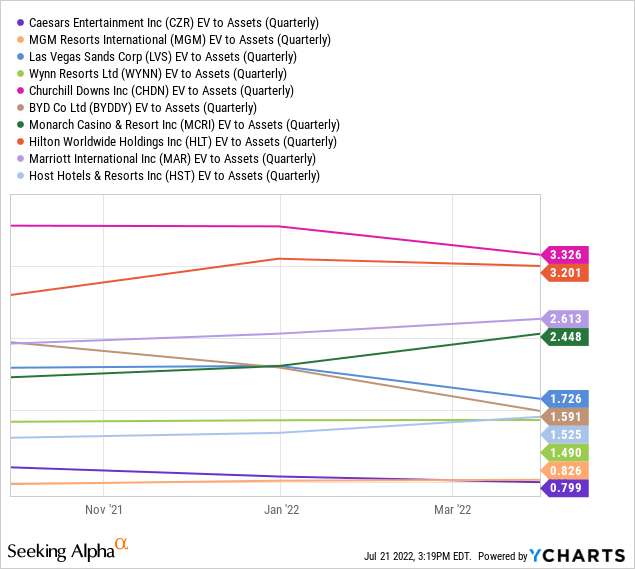

If you are searching for some bull arguments to offset the negative debt-bomb sitting on its balance sheet, CZR’s enterprise value totals (equity market capitalization + debt – cash holdings) are trading somewhat below the accounting value of its assets. Assuming the book value of its casinos accurately reflects current market values (which they may not in our post-pandemic world), Caesars is the cheapest selection in the peer group (if you can accept $15 billion in goodwill/intangible asset accounting on the mergers). In other words, if the economy recovers strongly in 2023 (think end of Russia/Ukraine war, political stability in the U.S. after November election, falling interest rates, nirvana basically), Caesars could have a decent physical asset foundation vs. peers under $50 per share.

YCharts

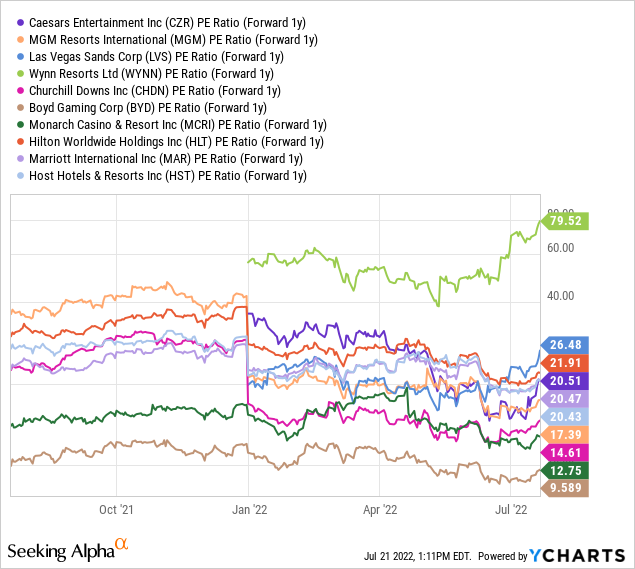

Optimistic analyst estimates are projecting a return to profitability in 2023. If an improving economy is our future, Caesars could now be selling for a forward 1-year P/E as low as 20x. Still on the high end of the peer group, but perhaps a valuation on income closer to projections of 20x EPS for the typical S&P 500 company.

YCharts

Final Thoughts

So, here are my bottom-line conclusions and forecast for the stock. If we get a mild recession in consumer spending from rising inflation and interest rates, similar to the first-half economic performance, Caesars will continue to lose decent amounts of money, and cash flow will barely be enough to pay bills. Under this scenario, I suspect the stock quote will find it difficult to get back above $50. It may trade as low as $30 in coming months.

However, if we get a deep recession with high or even spiking interest costs applied to Caesar’s debt (serious stagflation), large operating losses will be the future. Under this worst-case, stress-test like scenario, asset/property sales and possibly new equity issuance may become necessary. In my view, this would not be called “surviving” as an existing entity for shareholders, to answer the question in my article title. Stock quotes under $25 would almost surely become the norm for CZR. Of course, logically all the debt could bankrupt the company in a multi-year recession struggle, assuming sales/demand falls 20% or more for a sustainable period. Such a bearish outcome might mean the common equity price is headed to zero, while the company’s assets would eventually be divided between banks, bondholders and creditors, or new owners.

If you want to contemplate the required variables for a bullish push higher, stronger consumer spending and lower interest rates would have to appear soon. Absent both positives showing up into the autumn, I expect CZR’s quote will remain under $50, likely treading water around $35-40 until 2023.

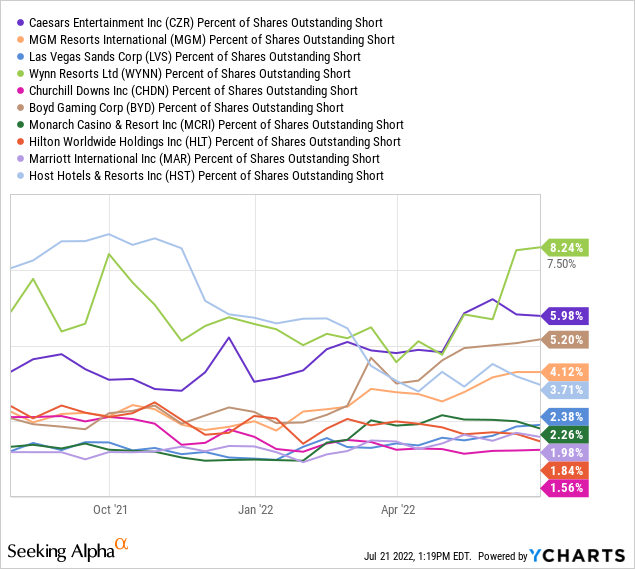

Again, my pessimistic take is no longer a contrarian, outlier theory. Rising short interest is a testament to the fact “too much debt” is a problem many other traders/investors/analysts are worried about. Casino stocks have a history of being one of the worst sectors to own in recessions, as travel and entertainment spending is easily cut by consumers. The short position in Caesars has roughly doubled since the beginning of the year, and is one of the highest ratios of outstanding shares in the peer group.

YCharts

Seeking Alpha’s Quant Ranking, a computer model that evaluates stocks based on financial data, price performance, and analyst estimates, reports Caesars is closing in on a Bottom 10% setup for new investment, out of a universe of 4,600 names. I believe this score may prove overly optimistic and generous.

SA Quant Ranking for CZR – July 21st, 2022

I rate CZR shares a Sell and Avoid until better clarity on economic growth appears in the overall U.S. economy. Best-case upside is likely only a bounce back to $60, if interest rates decline and consumer spending is stronger in the second half of 2022 vs. the first. With the odds of a bull run listed as very unlikely, focusing on potential downside all the way to ZERO should scare away most rational investors. Over the next 12-18 months, measured from $44 a share, potential gains of +40% vs. downside of -100% is my argument for a continued bearish view on this leading casino/hotel operator. Don’t gamble your hard earned money on Caesars.